North American e-commerce in figures

The North American B2C e-commerce market is expected to grow by 7.5% annually in the forecast period and reach $1,340.8 billion by 2030, driven by the growing adoption of mobile technology and online shopping amid the COVID-19 pandemic.

US e-commerce sales are projected to continue to grow by double digits, going up 17.9% in 2021 to $933.30 billion.

US consumers spent $933.30 billion on e-commerce in 2021, up 17.9% YoY, which comprised 15.3% of total retail sales.

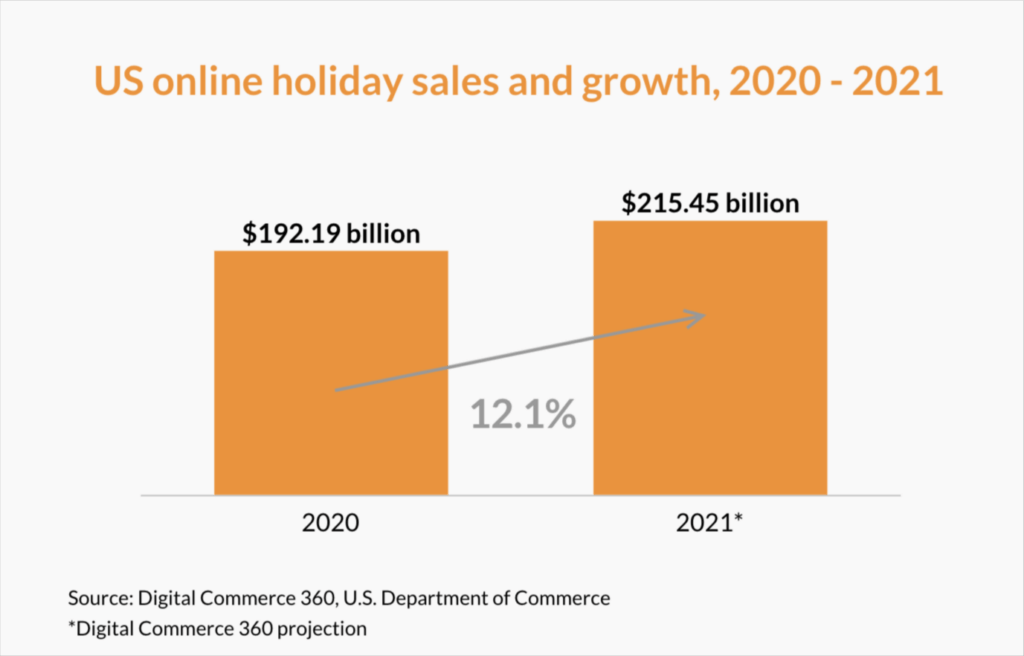

US online holiday sales

Strong holiday sales made total 2021 U.S. online retail sales up to $886.20 billion. Digital Commerce 360 estimates a 16.2% increase from $762.68 billion in 2020 and a whopping 53.2% jump from $578.50 billion in 2019.

However, for the first time, Adobe Analytics reported a drop in Black Friday sales to $8.9 billion—just shy of the 2020 record. Some theorize that this was the result of lingering pandemic effects (out-of-stock items, longer shipping times, etc.) in addition to earlier online deals perhaps stealing some of the momentum.

Black Friday is not a one-day affair, and shoppers who wanted to snag some extra virtual deals also took advantage of Cyber Monday.

So far, from Nov1 through Cyber Monday, consumers in the United States have spent $109.8 billion online, which is up 11.9% year-on-year, Adobe said. And on 22 of those days, consumers purchased more than $3 billion worth of goods—another new milestone, it said.

Adobe anticipates digital sales from Nov 1 to Dec 31 will hit $207 billion, which would represent record gains of 10%.

Why did this year’s holiday shopping season start earlier?

NRF CEO Matt Shay said people bought many gifts in October because of concerns about out-of-stock items amid supply chain challenges. And news of the Omicron variant of Covid-19 over the Thanksgiving shopping weekend caused some uncertainty about how consumers will shop and what they might buy.

The number of shoppers during the extended Thanksgiving weekend, which spans from Thursday to Cyber Monday, fell in comparison to both last year and 2019. Nearly 180 million Americans shopped during the five-day holiday weekend compared with about 186 million shoppers in 2020 and about 190 million in 2019.

Average spending declined, too, with Thanksgiving weekend shoppers shelling out an average of $301.27 on holiday-related purchases versus $311.75 in 2020 and $361.90 in 2019, according to NRF.

2021 Fourth-Quarter Results by Admitad Affiliate North America

In Q421, total sales in North America grew by approximately 15 percent when compared to the same period in 2020, and reached over $69,9M.

Going into Black Week 2021, our affiliates made more than $9M in North American total sales; the average order value (AOV) showed a 55% increase from last year.

During the BFCM Week 2021, the following top 3 product categories saw a considerable growth in terms of sales:

- Apparel, footwear, accessories

- Electronics & Household Appliances

- Car Rentals

The top-converting traffic sources for the period were as follows:

- Forums

- Coupon sites

- Affiliate stores

Xmas 2021 sales were up 26% over last year, hitting almost $5M with a year-over-year AOV increase by 71%.

The following product categories saw a boost from consumers on Xmas 21 week:

- Apparel, footwear, accessories

- Hotels

- Electronics & Household Appliances

The top-performing traffic sources that demonstrated a surge in sales during Xmas sales 2021 were:

- Affiliate stores

- Forums

- Cashback services

We hope that you ended Q4 strong both in terms of sales and earnings. We wish you every success in 2022! May the new year be prosperous and happy!